utah food tax calculator

Rates include state county and city taxes. The restaurant tax applies to all food sales both prepared food and grocery food.

Income Tax Calculator 2021 2022 Estimate Return Refund

After a few seconds you will be provided with a full breakdown of the tax you are paying.

. To use our Utah Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Filing 3000000 of earnings will result in 144773 of your earnings being taxed as state tax calculation based on 2021 Utah State Tax Tables. Utah Salary Paycheck Calculator.

The Utah Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Utah State Income Tax Rates and Thresholds in 2022. Local-level tax rates may include a local option up to 1 allowed by law mass transit rural hospital arts and zoo highway county option up to 25 county option transportation town option generally unused at present by most townships and resort taxes. Both food and food ingredients will be taxed at a reduced rate of 175.

Of course Utah taxpayers also have to pay federal income taxes. See Pub 25 Sales and Use Tax for more information. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. No cities in the Beehive State have local income taxes. The state sales tax rate in Utah is 4850.

Sales Tax Calculator Sales Tax Table. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or nutrition. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

With local taxes the total sales tax rate is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The Utah UT state sales tax rate is 47.

All taxpayers in Utah pay a 495 state income tax rate regardless of filing status or income tier. This Utah hourly paycheck calculator is perfect for those who are paid on an hourly basis. Details of the personal income tax rates used in the 2022 Utah State Calculator are published below the calculator this.

Utah Income Tax Calculator 2021. Maximum Local Sales Tax. Report and pay this tax using form TC-62F Restaurant Tax Return.

If you make 202500 in Utah what will your salary after tax be. Utah State Sales Tax. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys property.

The restaurant tax applies to all food sales both prepared food and grocery food. Calculate your Utah net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Utah paycheck calculator. Although this is the case keep in mind.

You may use the following worksheet to calculate your Utah use tax. In Texas prescription medicine and food seeds are exempt from taxation. Depending on local jurisdictions the total tax rate can be as high as 87.

Overview of Utah Taxes. The tax on grocery food is 3 percent. For comparison the median home value in Utah is 22470000.

Grocery food does not include alcoholic beverages or tobacco. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Utah local counties cities and special taxation districts. It is not a substitute for the advice of an accountant or other tax professional.

Back to Utah Sales Tax Handbook Top. Just enter the five-digit zip code of the location in which the. The Utah UT state sales tax rate is 47.

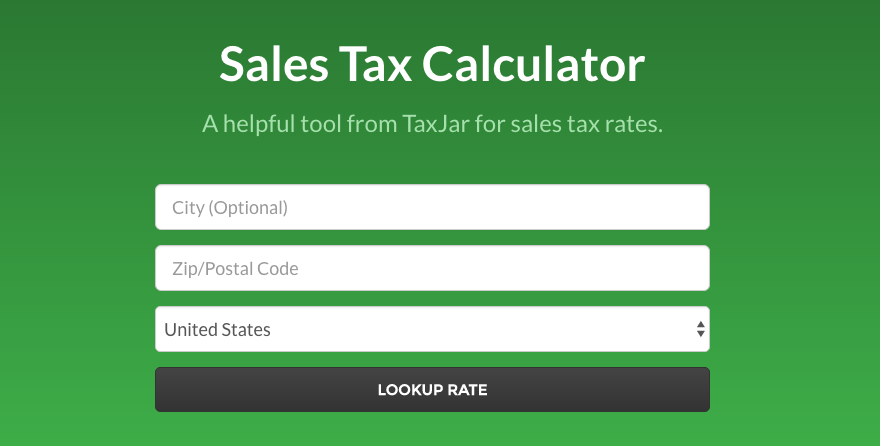

Switch to Utah salary calculator. You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. In the state of Utah the foods are subject to local taxes.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Average Local State Sales Tax.

See Utah Code 59-12-602 5 and 59-12-603 1 a ii Pub 55 Sales Tax. And all states differ in their enforcement of sales tax. 2020 rates included for use while preparing your income tax deduction.

Our income tax and paycheck calculator can help you understand your take home pay. Utah has 340 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Utah residents only.

The Utah Department of Revenue is responsible for publishing the latest Utah State Tax. This results in roughly 5638 of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on. Effective tax rate.

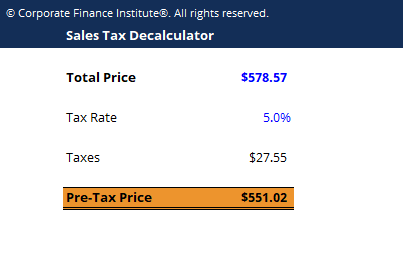

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835. Vermont has a 6 general sales tax but an. Before-tax price sale tax rate and final or after-tax price.

The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Marginal tax rate 32. Utah UT Sales Tax Rates by City.

The Utah State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 Utah State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities.

Maximum Possible Sales Tax. Utah has a higher state sales tax than 538 of states. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor.

The latest sales tax rates for cities in Utah UT state. Utah has a very simple income tax system with just a single flat rate.

The Consumer S Guide To Sales Tax Taxjar Developers

Washington Income Tax Calculator Smartasset Com Travel Usa Seattle Ferry Travel

Psd Mockup Interface Dark Gui Psd Interface Graphing Calculator Web Design

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

California Tax Calculator Taxes 2022 Nerd Counter

How To Register For A Sales Tax Permit Taxjar

Free Utah Payroll Calculator 2022 Ut Tax Rates Onpay

Arizona Sales Reverse Sales Tax Calculator Dremployee

Calculation Stock Illustrations 93 858 Calculation Stock Illustrations Vectors Clipart Dreamstime

California Tax Calculator Taxes 2022 Nerd Counter

California Tax Calculator Taxes 2022 Nerd Counter

Home Accounting Composition Accounting Tax Services Tax Return

Utah Sales Tax Small Business Guide Truic

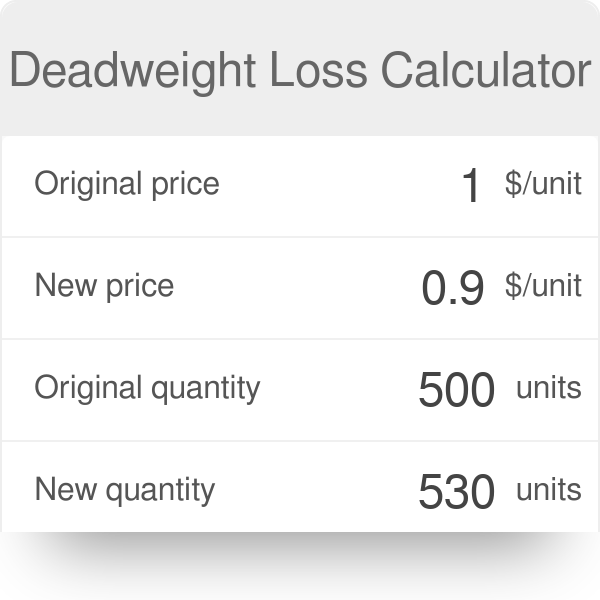

Deadweight Loss Calculator Find The Economic Deadweight Loss

How To Charge Your Customers The Correct Sales Tax Rates

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price